May 1, 2024

Emotional Intelligence 101: What Is It And How Does It Apply To The Workplace?

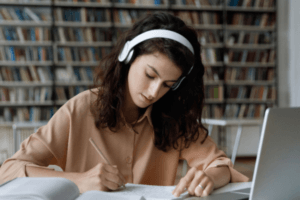

Discover why emotional intelligence is important in the workplace and learn practical techniques for developing it. Whether you're a team leader or employee, applying emotional intelligence can help you build stronger relationships, communicate effectively, and achieve your professional goals.

by Christopher Pappas