April 26, 2024

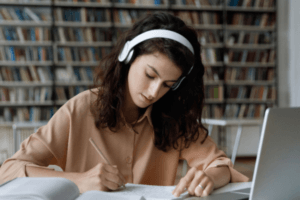

5 Benefits And Challenges Of Cloud Computing In Education

Cloud computing has allowed education to veer away from textbooks and redirect toward a technology-reliant method of sharing and receiving information. However beneficial it can be, institutions should also be aware of the challenges and work hard to ensure smooth and secure operations.

by Christopher Pappas