April 19, 2024

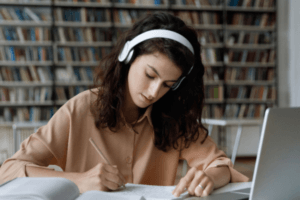

Strategies For Maximizing Remote Employee Engagement

Working from home is something many people will never want to change. However, it is not flawless and can harm productivity and satisfaction. If you stick around, you'll discover how companies can overcome any hurdles and maximize their workforce's engagement.

by Christopher Pappas