April 24, 2024

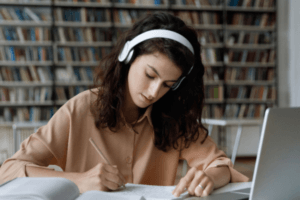

Exploring Classical Conditioning In Learning: Stages And Examples

People learn in conscious and unconscious ways, with the latter referring to the automatic learning process through association. Discover how classical conditioning was born, thanks to one experiment.

by Christopher Pappas