April 25, 2024

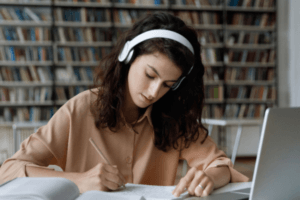

7 Ways To Enhance Learning Outcomes With The Help Of AI

Embrace AI in education and explore all the ways it can improve learning outcomes through innovative tools and ideas.

by Christopher Pappas